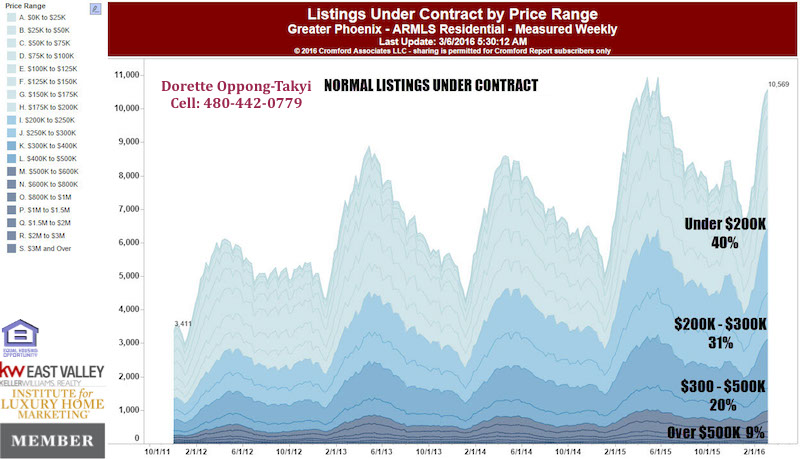

Listings Under Contract Up Nearly 9% from Last Year

Monthly Median Sales Price Up 6% from Last Year

50% of Monthly Sales Over $211,900

If you are looking to buy a home in the Greater Phoenix Area

We are in the heat of buyer season in the Phoenix Metro area. If you are one of many looking for a home under $200,000, bear in mind that this price range currently makes up 24% of active listings and 40% of sales in the Arizona Regional MLS. This reflects the high level of buyer competition for these listings, especially those in good condition. While inventory under $200,000 is down 24% from March of last year, the good news for buyers is that the overall inventory level has stopped declining for the time being after 2 years of consistent depletion. Buyers over $500,000 have lots of inventory to look through. This market currently makes up 26% of inventory and 9% of sales in the MLS. Annual sales are increasing in this price range, so there is still decent competition for exceptional properties in popular central locations. (Search Homes for Sale here http://www.luxurylivinginphoenix.com/)

Looking to sell a home in the Greater Phoenix Area

If you are a seller with a listing under $200,000, demand is very high for your price point. However, the buyer pool has changed significantly over the past few years; reaching too high in price initially could prove detrimental to your time on market. There are 3 types of buyers out there today:

1. Investors – These buyers are generally not interested in purchasing a property at market value, so listing too high will kill their interest.

2. First-time Home Buyers – These buyers are generally reliant on financing, thus the need for an appraisal. Many of them will not have the cash to bridge the gap between appraisal and contract price. If there’s any concern that a property will not appraise close to asking price, then they will not submit an offer and tie up their earnest money for weeks in escrow.

3. Boomerang Buyers – These buyers may have the cash to cover the gap between appraisal and contract price, but they are very nervous to do so. They have already gone through a foreclosure or short sale and have just gotten a clean bill of health on their credit report after 4-7 years. Having already paid over appraisal in 2005-2006, then suffering a foreclosure in 2008 or 2009, the memories of the consequences are fresh in their mind and they are wary of “paying too much”.

Because appraisals have become more important to a successful sale compared to 2009-2013, the market is seeing an increase in weekly price reductions along ALL price points, even on the lower end. Appreciation is still very good for properties selling below $300,000, but don’t expect annual appreciation similar to 2013 where it reached up to 20% in some areas. A more reasonable expectation would be 4-9% for properties selling under $300,000, even in a frenzy market. Sales over $300,000 are experiencing flat or declining annual appreciation due to an increase in competition, which means your property in this price range may sell for about the same or less than your neighbor’s home did last year. This is especially true for those listed over $1 Million.

(Written by Tina Tamboer-Glatfelter, The Cromford Report)